Respect is due to Strategy (formerly MicroStrategy), and to sir Michael Saylor in particular, for bringing Bitcoin out of the fringe… and into the financial mainstream. Their aggressive accumulation and clear communication helped shape the public and institutional understanding of Bitcoin as a long-term asset — a digital form of monetary energy, or should I say his. As there have been a ongoing amount of key Bitcoin supporters over the years, I mean in regards to the wall street-Bitcoin crossover, MSTR name holds weight, and rank.

That said, Strategy is still a centralized, publicly traded corporation. It operates within the constraints of capital markets, shareholder expectations, and corporate finance — all things Bitcoin, by design, does not. This distinction matters, as it is a key part of the MSTR pitch, around Bitcoin versus centralized coins like XRP for example.

I have no current position in MSTR as I write this — this is simply a framework I use to track relative sentiment and pricing versus BTC.

What is the infamous mNAV Multiple?

MNAV stands for Multiple Net Asset Value. The MNAV multiple is a quick way to tell how much investors are willing to pay for a company’s Bitcoin exposure relative to the actual value of the BTC it holds.

Think of it like this

Start with BTC value — How much is the Bitcoin on the balance sheet worth at current prices?

Subtract debt — What's left after liabilities?

Divide by shares — That gives you the Bitcoin NAV per share.

Compare to the stock price — That’s your MNAV multiple.

In simple terms

MNAV multiple = Stock Price ÷ BTC NAV per share

It’s a proxy for market sentiment toward the company’s BTC exposure, execution, leverage, and future expectations.

Source: Strategy 2025-08-16 9:36pm Pst

Why Does It Matter?

At 24K, we track the MNAV multiple as one of several inputs to assess sentiment and positioning. While not a trading signal on its own, we’ve observed that sustained moves above 2.25–2.30× tend to reflect stretched optimism — where cautious selling often pays. Conversely, ranges between 1.0–1.5× have historically aligned with broader skepticism and better long-side setups, especially when BTC itself remains constructive.

These ranges aren’t rules — just recurring patterns worth watching.

Above ~2.3× tends to signal peak optimism — often when BTC is flying, and MSTR gets treated like a momentum proxy.

Below ~1.0× is rare but notable — it suggests deep skepticism, fear of dilution, or that the market prefers cleaner access via ETFs.

At ~1.4–1.6×, which is roughly where MSTR trades today, you’re in the middle: cautious premium territory.

We consider anything >2.3× a zone for short setups or at least de-risking.

Below ~0.9×, it starts looking like a long-side opportunity — not purely off MNAV, but as a factor.

Todays premium sits around 1.4–1.6×, depending on how you account for dilution. Not cheap. Not frothy. Just quiet, mid-cycle positioning.

Why Premiums Exist

MSTR trades at a premium to its BTC NAV for a few key reasons…

Access: Institutions gain Bitcoin exposure through a regulated equity — no wallets, no custody.

Leverage: Strategy uses debt and preferred’s to amplify BTC exposure.

Optionality: The firm can issue stock at high multiples to acquire more BTC.

Brand: Saylor built a strong narrative and first-mover reputation.

Still, none of this is permanent. When sentiment fades or ETFs offer cleaner access, the premium seemingly compresses — and fast.

Exploring Strategy

MSTR has pulled back after a multi-month rally. The current level sits near a prior support zone from Q1 2025. ($340-$350)

Source Per: Seeking Alpha

As seen below, Put/call ratios ticking up, leaning defensive.

Quiet hedge flows, not fear — just worth noting.

Source: Barchart

Ownership Breakdown (as of July 2025)

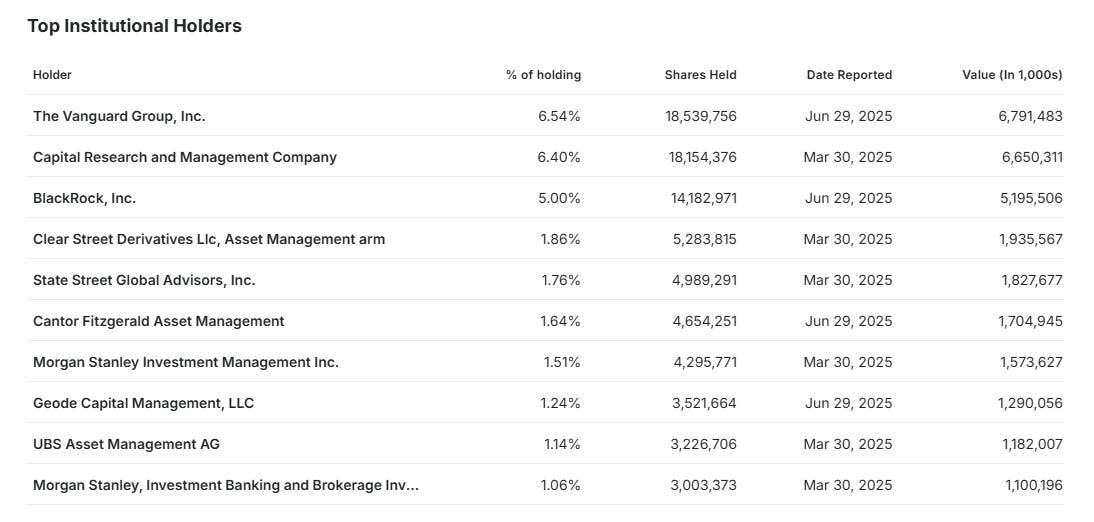

MSTR's shareholder base is diverse, with retail and public company holders owning the majority (57%), followed by mutual funds (24%) and other institutional investors (19%). Top institutional holders include Vanguard (6.5%), Capital Group (6.4%), and BlackRock (5%), while notable mutual fund positions are led by The Growth Fund of America (3.65%) and Vanguard ETFs.

This ownership mix supports liquidity — but also means sentiment shifts can move fast.

Source Per: Investing.com

Source Per: Investing.com

Source Per: Investing.com

Conclusion

At 24K Research, we track both Bitcoin and Strategy (MSTR). Not because they’re the same — they aren’t — but because together, they tell you how markets are interpreting the broader digital asset narrative specific to Bitcoin.

MNAV multiple is not the whole story, but it’s a useful and unique one. It helps show when fear gets overdone, when greed gets ahead of itself.. and when markets are paying too much or too little for exposure.

Regardless of how you feel about Strategy, one thing’s undeniable: it trades. The ticker should quite literally be VOL. Not just because Volume flows, and sentiment moves—because volatility is crowned with MSTR.

Source Per: Strategy

Thanks for reading.

This information is Never Financial Advice. It is for information and research purposes only.