Introduction

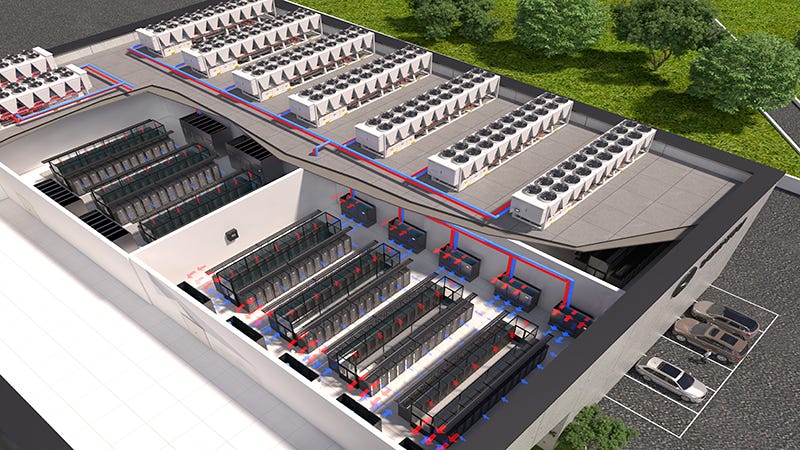

Vertiv has moved well beyond its roots as a mid-tier industrial spin-off, becoming a central player in the AI-driven data center build-out. Under CEO Giordano Albertazzi, the company has delivered multiple years of double-digit revenue growth, tightened its manufacturing footprint, and executed targeted acquisitions that deepen its moat in high-density power and cooling systems.

Q2 2025 reinforced that arc. Revenue climbed 35% YoY, EPS rose 42%, and backlog hit a record $8.5B — all while navigating tariff pressure. This wasn’t a one-off quarter; it was another data point in a pattern of disciplined execution.

Albertazzi’s approach is deliberate: secure long-cycle hyperscaler and colocation orders, integrate acquisitions like Great Lakes Data Racks to expand vertical control, and entrench Vertiv as the go-to provider for AI-scale thermal and power systems. The market is not the problem — demand is visible and expanding. The next phase hinges on converting backlog into revenue at higher margins, executing on strategic partnerships such as OKLO for clean-power cooling, and defending share in a tightening competitive field.

Image Source: Backend News

Thesis

Vertiv sits at the intersection of a structural demand wave and a short-term profitability squeeze. On one side, AI-driven data center expansion is accelerating at a pace the company has not seen since going public — validated by a $8.5B record backlog, double-digit organic order growth, and long-cycle contracts with hyperscalers and colocation providers. On the other, adjusted operating margins have compressed 110 bps YoY, reflecting tariff headwinds and some scale-up costs.

The investment case seems to hinge on whether Vertiv can translate this unprecedented demand visibility into sustained top-line growth and restore margins toward the 20%+ range, that would justify its premium valuation. Strategic moves — including the OKLO clean-power partnership, NVIDIA integration, and targeted acquisitions like Great Lakes Data Racks — deepen competitive moats in high-density power and thermal management. If execution holds and cost pressures normalize as guided, Vertiv has the runway to expand earnings power materially over the next 12–18 months, supporting further multiple expansion and positioning the stock for continued outperformance in the AI infrastructure cycle.

Vertiv’s sustainable data center design, seen below with it’s chilled water systems — engineered to meet today’s capacity demands while reducing environmental impact and lowering total equivalent warming impact (TEWI).

Image Source: Vertiv

Fundamentals

Revenue growth: Q2 2025 delivered +35% YoY revenue growth — the strongest pace since Vertiv’s IPO — with strength across all regions. Organic order growth of ~15% YoY, plus an 11% sequential gain, signals momentum that extends beyond one quarter.

Margins: Adjusted operating margin came in at 18.5%, down 110 bps YoY. The drag stems primarily from tariff-related costs and scale-up expenses tied to fulfilling the record backlog. Management maintains that these pressures are temporary and has guided for margin improvement into late 2025 as mitigation measures take hold.

Balance sheet: Liquidity stands at approximately $2.5B, providing flexibility for working capital, capex, and opportunistic M&A. Net leverage remains conservative at ~0.6x EBITDA, leaving headroom for strategic investment without pressuring credit metrics.

Valuation: Shares trade at 67× P/E and 17× P/B — a valuation premium to peers such as Eaton and Schneider Electric. That premium hinges on Vertiv sustaining high-teens to 20%+ operating margins and delivering consistent double-digit top-line growth.

Competitive edge: Vertiv’s integrated portfolio in power, cooling, and racks creates a one-stop-shop advantage for hyperscalers and large colocation customers. Switching costs are high due to embedded infrastructure and long-term service agreements, and its global service network adds a further layer of stickiness.

Institutional ownership is near 80%, reflecting strong buy-side conviction in Vertiv’s AI-centric growth story—but also the potential for outsized volatility if allocations shift. Vanguard and BlackRock alone represent ~18–19% of share ownership, underscoring passive and active accumulation.

VPE Holdings, LLC—an affiliate of Platinum Equity controlled by Tom Gores—owns nearly 10%. That stake gives them material influence both legally and in governance, though it's outside traditional insider trading patterns.

Institutional sentiment remains supportive. Recent 13F filings show increased positions from multiple funds, while UBS, Melius, and JPMorgan have all raised price targets. Insider trading activity is neutral — no significant selling into recent strength. Insiders themselves hold just 2–3%, aligning leadership with performance without creating entrenchment concerns.

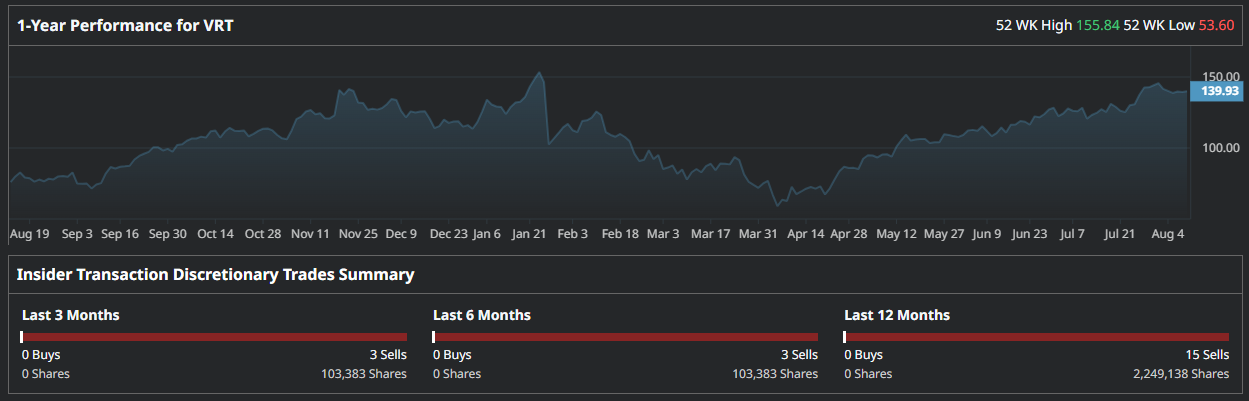

Over the past 12 months, insiders have reported 15 discretionary sales totaling 2.25 million shares, with no insider buys. The past six months saw 3 sales for 103,383 shares, and the past three months mirrored that same selling pattern. The absence of buying — even during pullbacks — suggests insiders are not signaling undervaluation through personal capital. However, this selling is not unusual given Vertiv’s strong price appreciation from a 52-week low of $53.60 to a high of $155.84, and may reflect profit-taking or diversification rather than a change in business outlook.

Image source: Barchart

Recent filings show most insider activity in Vertiv over the past year has been sales linked to option exercises or post-exercise disposals, alongside non-cash stock awards. EVP/CTO Stephen Liang executed the largest single sale — 33,683 shares post-exercise at ~$115.83, worth $3.9M — plus a direct 10,000-share sale for $1.16M. Regional CEO Karsten Winther sold 59,700 shares at ~$96.30 for $5.75M following an exercise. Divisional EVP Scott Armul sold 660 shares at $122.54. No open-market insider buys were reported. Most remaining transactions were stock awards to executives, with nominal changes to ownership percentages. The selling appears primarily compensation-driven rather than a broad signal of management exiting positions.

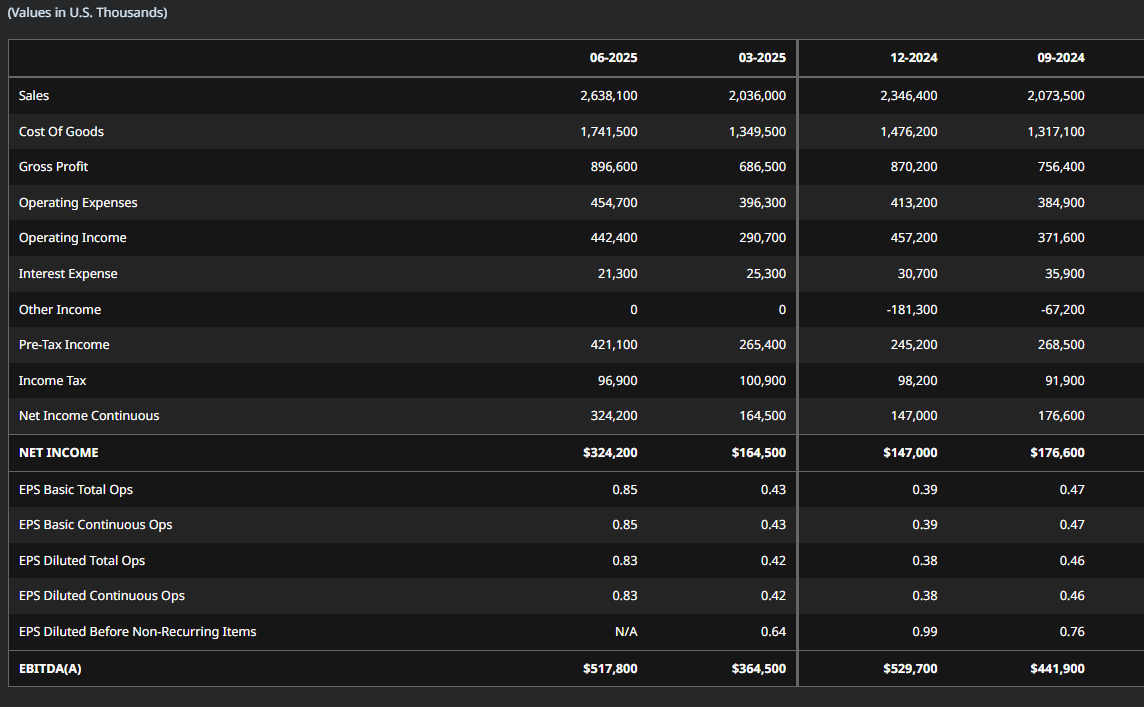

Image source: Barchart

Vertiv’s Q2 2025 income statement below reflects the company’s strongest quarterly revenue growth since IPO — sales rose 35% YoY to $2.64 B, supported by surging AI-driven data center demand. Gross profit expanded to $896.6 M, while operating income climbed to $442.4 M despite tariff-related cost pressures. Net income nearly doubled from the prior quarter to $324.2 M, with EPS of $0.85 (basic) and $0.83 (diluted). EBITDA reached $517.8 M, underscoring robust operating leverage ahead of expected margin recovery into year-end.

Image Source: Barchart

Catalysts

Backlog conversion: $8.5B in committed orders provides revenue visibility; the pace of conversion in H2 2025 will set expectations for 2026.

Strategic partnerships: Collaboration with OKLO positions Vertiv at the forefront of clean-power cooling solutions; NVIDIA alignment ties its offering directly to AI infrastructure demand.

Acquisitions: The purchase of Great Lakes Data Racks expands capacity and deepens its presence in thermal and rack systems.

Tariff resolution: Expected easing of tariff headwinds in 2026 would directly support gross and operating margin recovery.

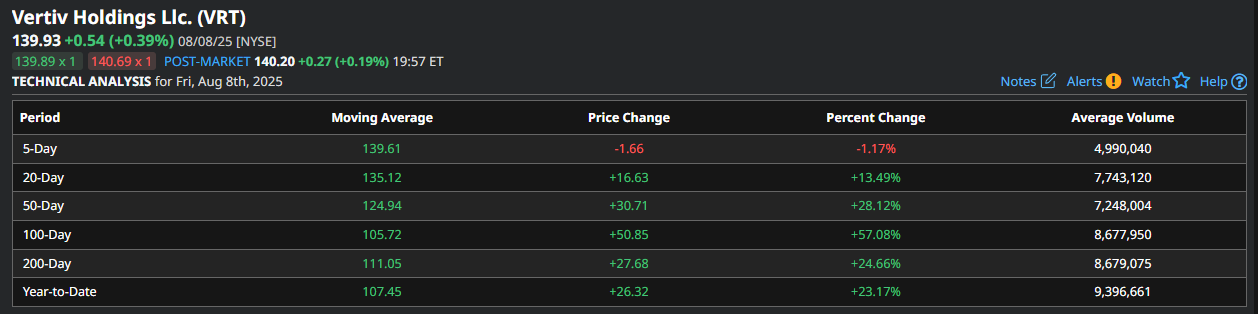

Technical

VRT is consolidating just under recent highs. $160 is the primary resistance level, $150 serves as first support. Price action remains constructive above the 50-day moving average. RSI sits in the mid-60s, indicating further upside potential before entering overbought territory. A decisive close above $160 could open the path toward $173–$180 — levels in line with UBS and Melius price targets.

Image Source: Barchart

Image Source: Barchart

Technical Snapshot (as of Aug 8, 2025)

VRT closed at $139.93, up 0.39% on the day and adding another 0.19% post-market cracking $140. Shares are trading just above the 5-day moving average ($139.61) and remain well above key longer-term support levels — 50-day ($124.94), 100-day ($105.72), and 200-day ($111.05). Price performance remains strong across all timeframes: +13.49% over 20 days, +28.12% over 50 days, and +57.08% over 100 days. Year-to-date, the stock is up 23.17% with average daily volume of ~9.4M shares, indicating sustained institutional participation. Momentum bias remains constructive while above the 50-day average.

Growth Trajectory

The AI infrastructure cycle is still in its formative stage, with capital deployment from hyperscalers, telecom, and large colocation providers accelerating to meet AI workload demands. These verticals represent the fastest-growing slices of global data center capex. Industry projections call for an 11%+ CAGR in total data center spending through 2030, with AI-specific cooling and high-density power systems expected to grow at an even higher rate. Vertiv’s portfolio — spanning liquid and chilled water cooling, modular power, and integrated rack systems — directly aligns with these high-growth needs. The combination of product breadth, global service reach, and embedded relationships with top-tier customers positions Vertiv to not only track but potentially outpace sector growth, expanding its share in a market that is itself expanding at double digits.

Risk Wrap

Net-slightly-bullish, but not complacent. Vertiv heads into the back half of 2025 with strong demand visibility, higher guidance, and positioning tied to the most capital-intensive parts of AI infrastructure, and at the right time. Near-term risk sits with the tariff resolution timeline, any slowdown in hyperscaler capex, and competitive pressure from global peers. Currently I initiated a hedged-long position from $139 and tracking closely for potential size adjustments. Will let the price action and execution tell the story from here.

Thanks for reading.

This is only intended for our exploration & independent research purposes only — this is not financial advice.